2025 didn’t break the world. It just exposed the lie.

How wars became background noise, markets stopped explaining themselves, careers stopped making sense, and machine became smarter — and why people still felt poorer, replaceable,

TLDR; I felt a need to write to understand contradictions, not smooth them over.

Every year pretends to be important. But some years don’t just pass - they invalidate assumptions.

2025 was one of those years.

Not because of a single crisis or breakthrough, but because many comfortable stories we relied on - about markets, wars, startups, India’s “rise”, AI, careers, pedigree, and global order - quietly stopped working.

The dashboards looked fine. The lived experience didn’t.

And that gap became impossible to ignore.

Markets stopped explaining themselves

One of the strangest contradictions of 2025 was this: markets appeared calm, yet people felt constantly on edge.

Volatility existed, but it was episodic. Corrections were shallow and quickly bought. Indexes recovered faster than narratives could catch up. On paper, capital markets looked rational.

But something fundamental had shifted. Markets stopped being explanatory.

Prices moved ahead of earnings. Liquidity mattered more than fundamentals. Short-term positioning overwhelmed long-term conviction. The “why” behind price action mattered less than knowing who else might buy next.

Retail investors oscillated between fear and FOMO. Professionals learned to trade narratives instead of businesses. Long-term investing quietly turned into tactical survival.

This seeped into everything else - careers, startups, even life planning.

The uncomfortable truth:

2025 markets didn’t reward insight. They rewarded positioning. And positioning, by definition, is unstable.

Conflict as an infrastructure, instead of event

By 2025, war lost its shock value.

Conflicts no longer erupted and resolved cleanly. They simmered, paused, fragmented, resumed - without conclusion. The world adapted not because it became safer, but because instability became familiar.

Energy markets absorbed shocks. Supply chains rerouted. Defense budgets normalized. Headlines moved on.

This normalization was the real change.

War stopped being an event and became infrastructure - a persistent input into energy prices, migration, capital flows, industrial policy, and technology access.

Modern wars weren’t fought for resolution.

They were fought for leverage. And once leverage is established, it rarely gets relinquished.

This mattered because it fed directly into markets, geopolitics, and long-term uncertainty - especially for countries and companies trying to plan beyond the next quarter.

“Fundamentals” didn’t save startups anymore

The neat post-mortem of 2025 goes like this:

“The market rewarded founders who focused on fundamentals.”

That story is comforting — and incomplete.

What actually happened was harsher:

Founders with leverage survived. Everyone else learned the language of fundamentals too late.

Distribution beat differentiation.

Access beat elegance.

Timing beat discipline.

Companies with average products but entrenched enterprise contracts survived. Technically superior startups with weak go-to-market quietly shut down.

Fundamentals mattered - but only after survival was secured.

The real lesson:

Being right without power is still losing.

Is there really an AI Bubble? (Not where you think)

The bubble in 2025 wasn’t “AI is useless or it is overhyped.” AI worked — that was the problem. Contrarian, but true.

While capital became costlier in 2025, it is being artificially discounted for AI opportunities. I met lot of notable institutions who just want exposure to AI, it doesn’t matter what it is or whether it will generate any value.

The bubble showed up elsewhere:

Too many AI wrappers chasing the same workflows

Identical demos differentiated by branding, not outcomes

Revenue lagging far behind inference costs

Talent costs rising faster than margins

Imbalance of expenditure and intellectual saturation across domains.

The ecosystem chose the winners very early - optimized on signals rather than substance. And consequently is trying to keep the cycle running on a belief system.

Capital recycled aggressively:

model company → cloud bill → infrastructure provider → back into AI funds.

Money moved in loops, not lines.

Uncomfortable truth:

In 2025, much of AI investment didn’t create new value.

It circulated value.

An identity crisis disguised as innovation for Indian deep tech ecosystem

India entered 2025 loudly declaring:

“We’re done cloning. Deep tech is the future.”

That statement sounded confident.

It wasn’t entirely true.

Yes, consumer internet cooled. Yes, more startups attempted EV infra, AI, robotics, climate, and industrial software. But many ran into the same structural wall.

We realized while India wants to be ambitious as global hedge against China, but there is still a large gap in talent, mindset, patience and alignment.

Founders still find it easier—and often rational—to build in India and sell outside it. Not because they want to leave, but because outcomes are clearer elsewhere, and execution is faster.

Top-tier talent remains magnetized by the US. What returns in the name of “reverse brain drain” is usually the median, not the edge.

High-risk domestic capital is limited. It prefers exposure through the US–India corridor rather than committing fully within India. Safety, not conviction, shapes most decisions.

Foreign capital remains hesitant. That’s the ground reality—regardless of how optimistic the narrative sounds. India excites investors, but rarely enough to absorb long cycles, regulatory ambiguity, or deep technical risk.

Workforce optimizes for stability over stretch. Comfort over uncertainty. That’s understandable—but it changes what kinds of companies can exist.

Customers are still final friction point, creating lack of early adopters due to pricing, bureaucracy and reluctance towards risk.

Deep tech thrives only when these incentives align. In India, they still didn’t keep up as per expectations.

Most “deep tech” startups struggled not because the tech failed — but because cash flow timelines and cultural expectations were incompatible. Those who survived were mostly based in Bay Area - not building for India as market, but rather using India as a cost center for economical development rather than decision making.

Uncomfortable truth:

Deep tech in India isn’t impossible - but without a mindset shift from momentum and optics to mastery and endurance, it remains largely performative.

The Indian economy appeared to be growing, yet quietly fucked up

2025 was full of headlines celebrating India’s macro strength.

They weren’t wrong - just misleading.

GDP growth didn’t translate into wage growth. Asset prices outran incomes. Consumption leaned on credit rather than confidence.

Millions weren’t unemployed. They were employed, educated, and anxious.

This wasn’t an economic collapse. It was an incentive collapse.

Too many aspirants chased too few genuinely high-quality opportunities. Growth existed, but it didn’t feel predictable, inclusive, or secure.

Hard truth:

Growth without productivity-linked income doesn’t create optimism.

It creates fragility.

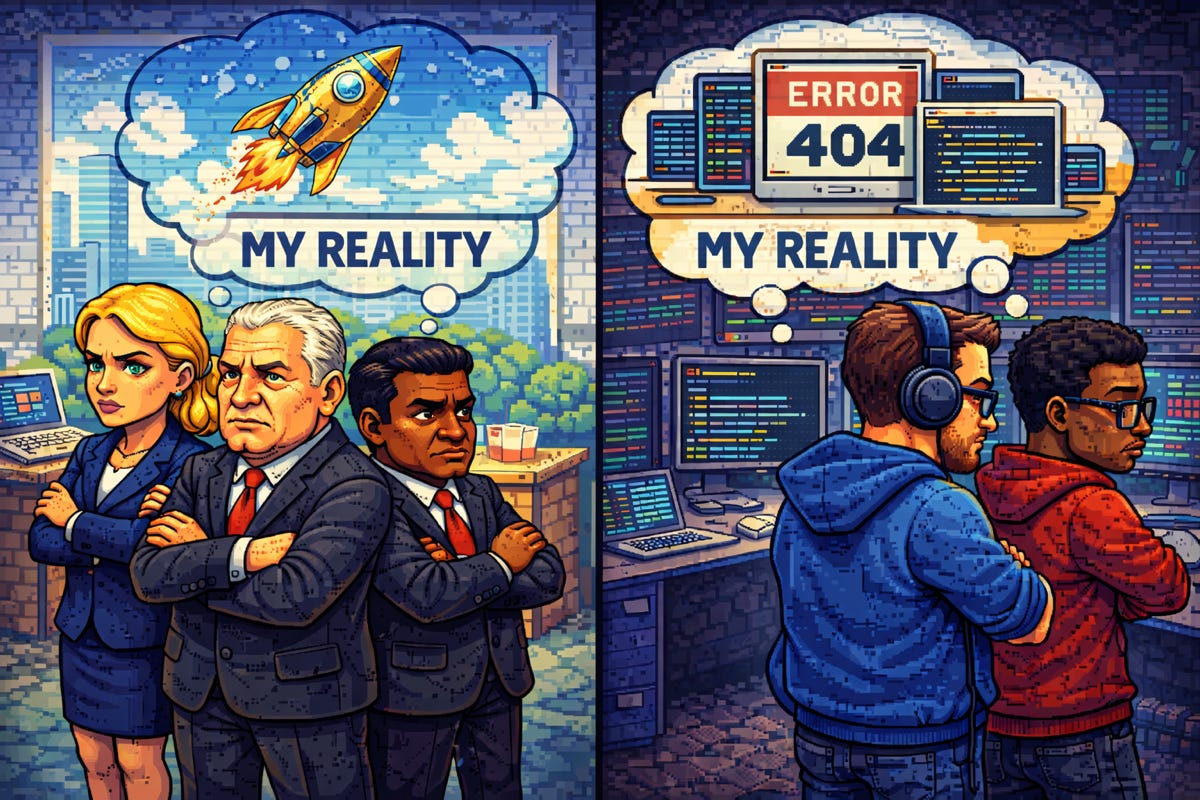

The collapse of the illusion of employment

The employment stress of 2025 didn’t come from sudden cruelty. It came from correction after excess.

For several years, capital was cheap and growth was cosmetic. Companies expanded headcount to signal momentum, not because work demanded it. Compensation drifted away from contribution. Hiring optimized for surface signals rather than sustained output.

Work felt lighter. Expectations softened. Salary jumps and job switches felt frictionless - driven by optical signals like pedigree instead of proof of work.

That phase trained a workforce on conditions that were never durable.

As markets tightened, the logic reversed.

Companies recoiled back to efficiency. Roles had to justify contribution. Output replaced optics. Rewards grew conditional.

This created a paradox:

Employers struggled to find people who met rising expectations and merits

Workers struggled to find roles that matched old assumptions - and felt a feeling of being undervalued.

Not because capability vanished - but because the reference point was wrong.

AI accelerated this shift by lifting baseline productivity — it didn’t cause it, despite the popular narrative.

Uncomfortable Truth:

The hardest adjustment wasn’t technical. It was mental.

A generation calibrated its expectations in an abnormal environment. When conditions normalized, the mismatch felt personal.

Optional awareness around geopolitics became a liability

Until recently, geopolitics was background noise for most professionals. 2025 ended that illusion.

Export controls affected hardware startups.

Visa regimes reshaped hiring.

Capital came with political assumptions.

Neutrality itself carried cost.

The world didn’t become hostile. It became conditional.

Reality check:

Globalization didn’t reverse — it fragmented.

And ignorance stopped being neutral.

Reflections going forward in 2026

2026 doesn’t need optimism and narratives, but rather repositioning how we make decisions, choose depth over chasing speed and build right incentives for evolutions.

The next decade won’t be exponential. It will be selective.

Last few years have normalized instability. 2026 won’t reward certainty.

It will reward those who can move without it. It will reward right positioning, rather than insight or ambition.

And in a world where the old stories no longer work, that may be the only real advantage left.

Happy New Year!

uncertainty is the new comfortable.

pedigree instead of proof of work 👌